|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best Online Home Refinance Options: A Comprehensive GuideRefinancing your home can be a strategic move to lower monthly payments or reduce interest rates. With online platforms, this process has become more accessible and convenient than ever. Understanding Online Home RefinanceOnline home refinance involves using digital platforms to apply for a new mortgage, replacing your existing loan. This method offers speed, transparency, and often competitive rates. Advantages of Online Home Refinance

Potential Drawbacks

Choosing the Best Online Refinance OptionWhen selecting an online refinance option, consider factors like interest rates, fees, customer service, and platform usability. For instance, if you're interested in an FHA loan, explore free fha streamline refinance for specific options. Factors to Consider

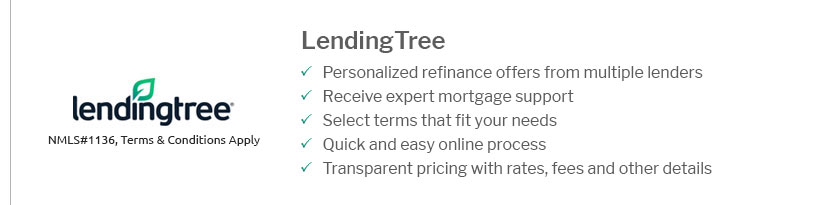

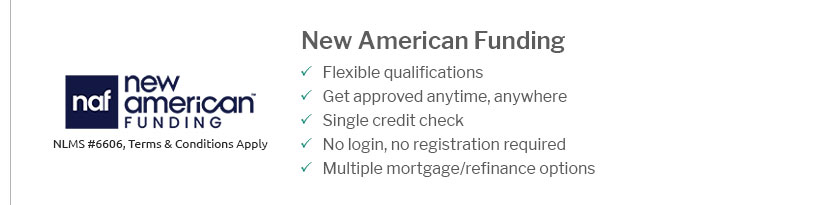

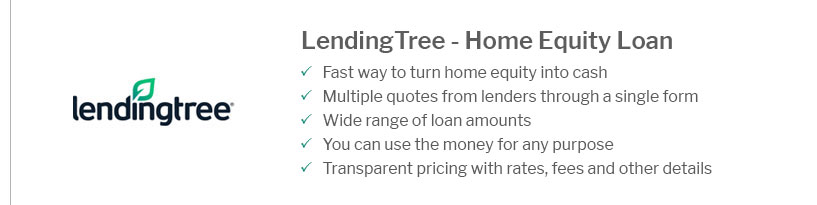

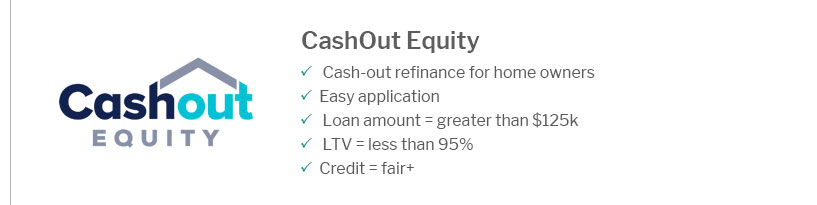

Top Platforms for Home RefinanceSeveral platforms are popular for online home refinance due to their user-friendly interfaces and competitive offers. For instance, those in Arizona might explore home refinance rates arizona to find suitable local options. Platform Features

FAQWhat is the typical time frame for an online refinance?The process typically takes 30 to 45 days, though some platforms offer faster processing times. Are online refinance rates better than traditional ones?Online platforms often provide competitive rates due to reduced overhead costs, but it's essential to compare individual offers. How secure is online refinancing?While online refinancing is generally secure, always verify that the platform uses encryption and other security measures. https://www.usbank.com/home-loans/refinance.html

An application can be made by calling 888-291-2334, by starting it online or by meeting ... https://better.com/

Better Mortgage Corporation is a direct lender dedicated to providing a fast, transparent digital mortgage experience backed by superior customer support. https://www.credible.com/mortgage

How to refinance your mortgage - How to get the best refinance rates - FHA cash-out plan - When to refinance - Mortgage refinance calculator. Compare Home ...

|

|---|